Unknown Facts About Transaction Advisory Services

Wiki Article

The Main Principles Of Transaction Advisory Services

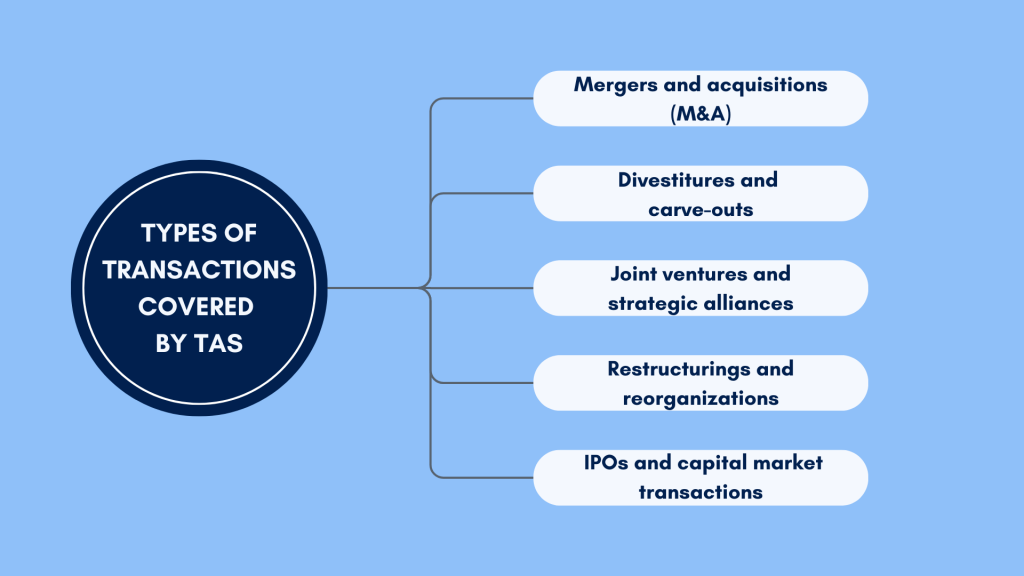

Table of ContentsAll About Transaction Advisory ServicesNot known Facts About Transaction Advisory ServicesWhat Does Transaction Advisory Services Do?Transaction Advisory Services Can Be Fun For Anyone8 Easy Facts About Transaction Advisory Services Explained

This action makes certain the company looks its best to potential purchasers. Obtaining the business's worth right is crucial for a successful sale.Purchase advisors step in to aid by getting all the required information organized, responding to questions from purchasers, and setting up sees to the business's place. Transaction consultants use their knowledge to aid company proprietors handle tough arrangements, meet customer assumptions, and structure deals that match the proprietor's goals.

Meeting lawful guidelines is crucial in any business sale. They aid organization owners in preparing for their next actions, whether it's retired life, starting a brand-new endeavor, or handling their newly found riches.

Deal experts bring a wide range of experience and knowledge, guaranteeing that every facet of the sale is managed properly. Via critical prep work, appraisal, and negotiation, TAS assists local business owner attain the highest possible sale price. By guaranteeing legal and governing conformity and handling due persistance together with other bargain employee, transaction advisors minimize potential threats and liabilities.

Not known Incorrect Statements About Transaction Advisory Services

By contrast, Large 4 TS teams: Work on (e.g., when a potential customer is carrying out due diligence, or when a bargain is shutting and the buyer requires to integrate the business and re-value the seller's Equilibrium Sheet). Are with costs that are not connected to the offer closing successfully. Make charges per engagement someplace in the, which is much less than what financial investment banks gain also on "small bargains" (but the collection chance is also much greater).

The interview inquiries are very similar to investment financial meeting questions, however they'll focus a lot more on bookkeeping and valuation and less on subjects like LBO modeling. Expect inquiries about what the Adjustment in Working Resources ways, EBIT vs. EBITDA vs. Earnings, and "accounting professional only" subjects like trial equilibriums and just how to go through occasions using debits and credit scores instead of monetary declaration modifications.

Not known Incorrect Statements About Transaction Advisory Services

that demonstrate how both metrics have altered based upon items, channels, and customers. to evaluate the precision of monitoring's previous forecasts., consisting of aging, supply by item, average levels, and stipulations. to establish whether they're completely imaginary or rather believable. Experts in the TS/ FDD teams might likewise speak with management concerning every little thing above, and they'll create a detailed record with their findings at the end of the process.The power structure in Transaction Solutions varies a little bit from the ones you could try these out in financial investment financial and exclusive equity occupations, and the basic shape resembles this: The entry-level function, where you do a great deal of information and financial analysis (2 years for a promo from here). The following level up; comparable job, however you get the more intriguing bits (3 years for a promo).

Specifically, it's hard to get try this out advertised past the Manager degree due to the fact that few individuals leave the job at that phase, and you require to start showing evidence of your capability to create revenue to breakthrough. Let's start with the hours and way of living considering that those are much easier to explain:. There are occasional late evenings and weekend break job, yet nothing like the frenzied nature of financial investment financial.

There are cost-of-living adjustments, so expect reduced payment if you remain in a cheaper location outside significant economic facilities. For all positions except Partner, the base salary comprises the bulk of the complete compensation; the year-end bonus may be a max of 30% of your base salary. Usually, the very best way to boost your earnings is to change to a various company and bargain for a greater wage and incentive

The Basic Principles Of Transaction Advisory Services

You could enter into corporate growth, however investment financial gets harder at this phase because you'll be over-qualified for Analyst functions. Corporate money is still an option. At this phase, you ought to just stay and make a run for a Partner-level function. If you wish to leave, perhaps relocate to a client and perform their appraisals and due persistance in-house.The primary problem is that since: You usually need to sign up with another Huge 4 team, such as audit, and work there for a few years and after that relocate right into TS, work there for a few years and after that move into IB. And there's still no warranty of winning this IB function since it depends upon your region, customers, and the employing market at the time.

Longer-term, there is likewise some danger of and since assessing a business's historical economic info is not specifically brain surgery. Yes, humans will certainly always this content require to be included, however with more advanced modern technology, lower headcounts might possibly support client interactions. That claimed, the Transaction Solutions team defeats audit in terms of pay, work, and departure chances.

If you liked this short article, you could be curious about analysis.

What Does Transaction Advisory Services Do?

Establish sophisticated economic structures that aid in figuring out the actual market worth of a firm. Give consultatory operate in connection to organization valuation to aid in bargaining and rates frameworks. Describe the most appropriate form of the offer and the sort of factor to consider to employ (cash, stock, gain out, and others).

Develop activity strategies for danger and exposure that have been recognized. Do combination planning to establish the procedure, system, and organizational changes that may be called for after the bargain. Make numerical quotes of combination prices and benefits to assess the financial rationale of assimilation. Establish standards for incorporating departments, modern technologies, and business procedures.

Examine the potential customer base, market verticals, and sales cycle. The operational due diligence uses essential insights right into the performance of the company to be acquired worrying danger evaluation and worth creation.

Report this wiki page